Spring 2016 brought with it an uncommonly sunny disposition

among buyers and managers of corporate travel and meetings, and not only

because their average compensation this year has continued to rise at a healthy

clip. The respondents to this year's salary survey, the 33rd annual edition of BTN's

examination of buyer compensation, were more likely than in previous years to

view their compensation as at least fair and feel their recognition within

their organizations to be at least adequate. They also are more likely to see a

path for their own industry advancement and predict higher salaries to come.

But this survey was fielded in April and May, before the

optimistic springtime was pierced by the summertime lightning bolt of the

United Kingdom's June 23 vote to depart the European Union. Whether the ensuing

global uncertainty of the consequences of the Brexit vote has darkened travel

managers' outlook can't be discerned from this survey, so it's appropriate to

view these results outside of that prism.

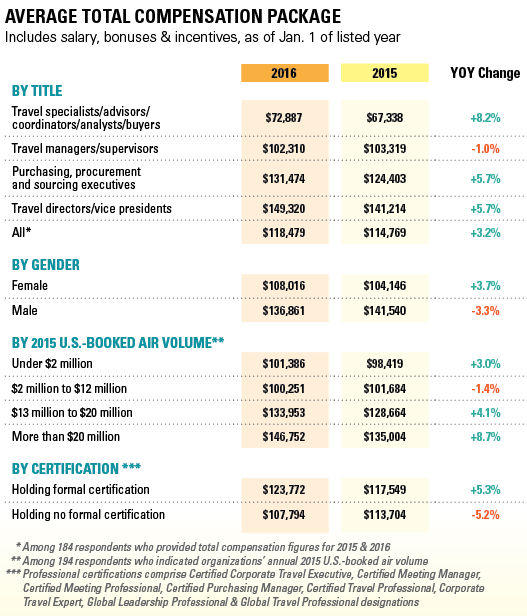

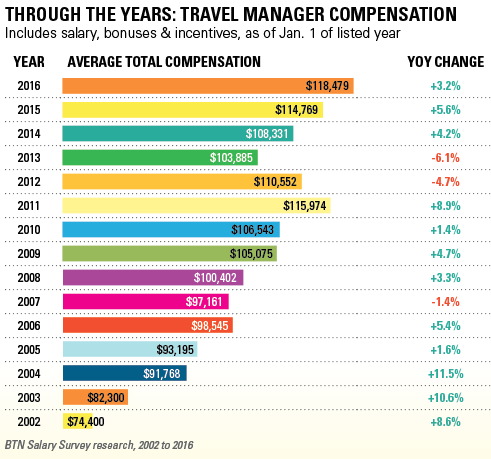

Otherwise, the view for travel management professionals is

pretty good: The average total compensation for this survey's 194

respondents—including salary, bonuses and incentives for respondents among all

company sizes and sectors—as of Jan. 1, 2016, was $118,479, a figure 5.5

percent higher than these same respondents reported as their compensation one

year prior. That growth far outpaces the U.S. Bureau of Labor Statistics'

year-over-year figures for overall U.S. compensation growth for civilian

workers and those in private industry, each of which was a little under 2

percent in the first quarter. It's also about 3.2 percent higher than the

$114,769 figure reported in BTN's 2015 salary survey.

As always, the flat average of respondents' compensation

tells only part of the story, as the figure varies widely corresponding to the

gender of the respondents and the annual airline spend of their organizations.

Still, it's the third straight year that the overall average compensation

figure in this survey has risen from the prior year's, and such consistent

average increases play a part in what appears to be travel buyers' improving

collective mood.

A Brighter Outlook

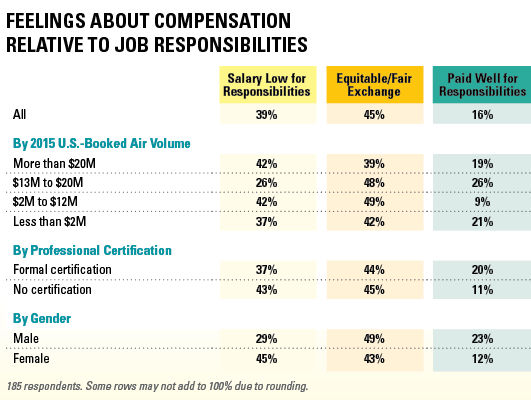

This year's respondents, generally speaking, are happier

with their pay relative to their responsibilities than they have been in recent

years. While 39 percent of respondents still consider their pay too low for

their workload, that is five percentage points lower than in 2014, and the 16

percent of respondents in 2016 who consider themselves "paid very well"

for their efforts is up from 13 percent in 2014. The remainders in both surveys

consider their compensation an equitable exchange for their work.

Respondents were asked to detail the biggest change to their

job during the past year, and while some took the opportunity to note

difficulties like lower visibility or more responsibilities without a

commensurate salary hike, others cited positive changes. "A new manager is

committed to fairness and has brought hope to the team," wrote one.

Another cited a promotion, though one in which "my job responsibilities

didn't change, but the company recognizes the value of my position. Changed

[my] title and gave me a raise."

Still another noted a corporate implementation of an

automated expense management tool: "So happy to come out of the Dark Ages.

I felt like I was falling behind the times because my company did not use the

latest and greatest technology."

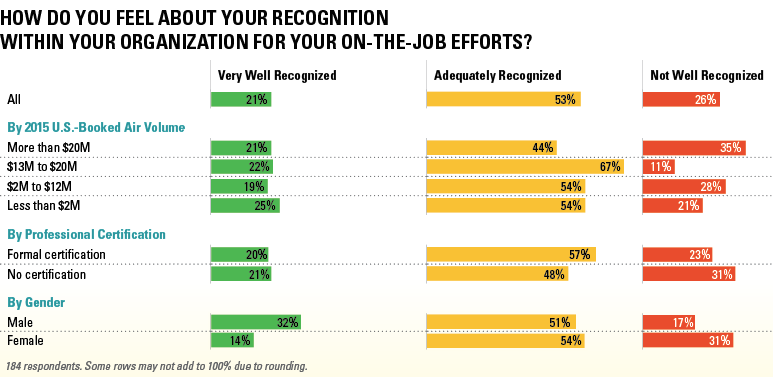

Organizational recognition for many is a key aspect of job

satisfaction; employees in any industry like to feel their work is valuable.

Fewer respondents to this year's survey feel they are "not well recognized"

by their organizations than in the prior two years: 26 percent this year versus

30 percent in 2015 and 29 percent in 2014. While the share of respondents who

call themselves "well recognized" has remained constant during that

timeframe, those who cited "adequate" recognition rose to 53 percent

in 2016 from 47 percent in 2015 and 49 percent in 2014.

It should be noted that there is a significant split between

men and women with regard to their satisfaction with pay and recognition. While

23 percent of male respondents consider themselves paid well for their

responsibilities and 32 percent indicated they were "very well recognized"

by their organizations, those numbers among female respondents dip to 12

percent and 14 percent, respectively. Conversely, 45 percent of women indicated

their salary was too low for their responsibilities and 31 percent consider

themselves "not well recognized" in their workplaces, but just 29

percent and 17 percent of male respondents, respectively, said the same.

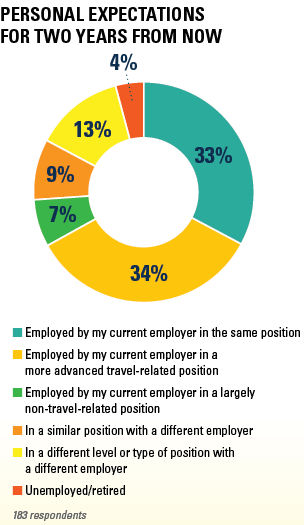

Meanwhile, respondents on the whole indicated they see

better chances of advancement and brighter prospects for higher salaries in the

next few years. When asked where they would be professionally in 2018, 34

percent of all respondents predicted they would still be employed by their

current organization but in a more advanced travel-related position. That's not

only the most frequent response this year, just edging out the 33 percent who

project they'll be in the same position in two years, it's also higher than the

31 percent who in 2015 predicted advancement within the following two years and

the 29 percent who did so in 2014.

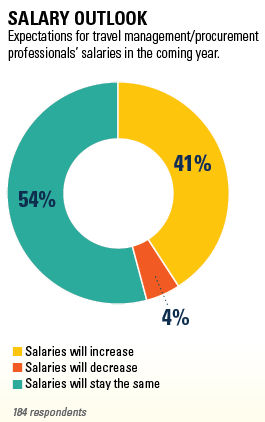

While most respondents, 54 percent, expect that travel

management and procurement professionals' average compensation generally will

hold steady during the next year, 41 percent believe it will increase, up from

the 39 percent both in 2015 and 2014 who—correctly, it turns out—forecasted

higher average salaries in the forthcoming year.

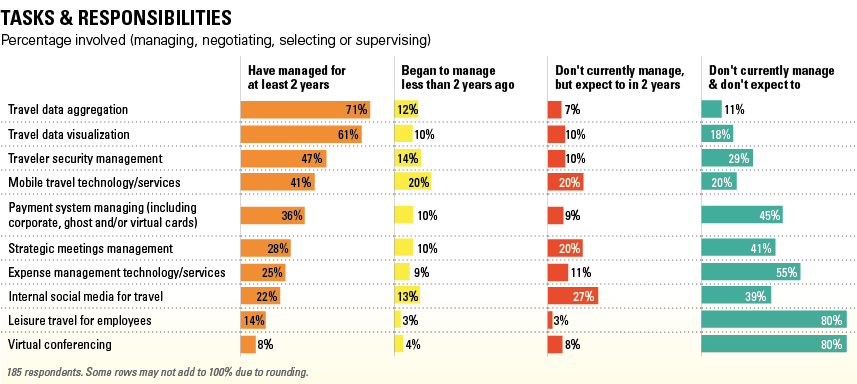

Evolving Responsibilities

There is a level of consistency, and has been for many

years, among certain professional responsibilities in travel management roles

regardless of organizational size or industry type: managing relationships with

airlines, hotels, travel management companies and other suppliers; managing travel

technology; and helping set and implement travel policy. But 2016 has brought

with it increased responsibility for travel managers and projections of further

involvement with two aspects in particular: mobile technology and social media.

No surprise, perhaps, given the level of attention those two topics, and how to

manage them, has received within the business travel industry. This year's

survey respondents indicated those two trends are affecting their roles on a

more granular level, and they expect even more involvement to come.

BTN asked respondents to note their involvement—in

terms of negotiation, management, supervision and selection—with 10 aspects of

travel management outside the standard foundation of the profession. More

respondents indicated that within the prior two years, they had assumed

management of mobile travel technology and services than they took on for any

other of those 10 aspects. Now, 61 percent of respondents manage that function,

and another 20 percent expect to do so by 2018.

It's yet another indication that many organizations, in some

cases spurred by their travelers, have shifted from deciding whether to involve

their travel management personnel in mobile technology decisions to determining

how best to do so. Only one in five respondents indicated that they do not

expect to have any involvement in mobile technology management by 2018.

Meanwhile, 27 percent of respondents are not involved in the

management of internal social media for travel but expect to be by 2018, the

highest figure among the offered roles. That 27 percent would join the 35

percent of respondents who already manage social media for travel, more than

one-third of whom have picked up that responsibility since 2014.

Several respondents, in fact, cited social media

implementation as the biggest change to their job within the past year. "Social

media presence has grown by leaps and bounds," wrote one. Another said, "Much

more involved with internal social media and focusing more on becoming more traveler-centric."

Other travel management functions for which respondents

picked up additional responsibility in the past two years include traveler

security management (14 percent of all respondents) and travel data aggregation

(12 percent). About one-fifth of all respondents expect to assume

responsibility for strategic meetings management initiatives by 2018, while 38

percent already do. Remote conferencing still hasn't gained a strong presence,

at least among travel managers, as just 12 percent of respondents are

responsible for the technology and only 8 percent more expecting it by 2018.

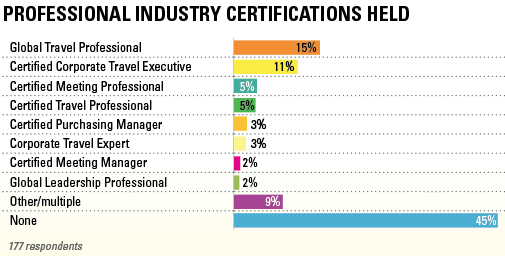

Certification Consequences

Several industry organizations offer professional

certification to those who pass high-level education classes. In BTN's

survey, about 55 percent of respondents indicated they held at least one such

designation, including but not limited to the Global Business Travel

Association's Global Travel Professional certification, the Convention Industry

Council's Certified Meeting Professional designation and the Institute for

Supply Management's Certified Purchasing Manager certification.

While comparing compensation figures based on such

certifications is a tricky endeavor, not only because of small sample sizes but

also because younger, less experienced respondents are less likely to hold such

designations than those with higher-level roles and more experience, the

results of BTN's survey show that certified respondents on the whole

earn an average total compensation package of $123,772 versus $107,794 for

those respondents without. Those figures were much closer in the 2015 survey,

with respondents with certification earning $117,549 and those without earning

$113,704.

These respondents collectively have differing attitudes

toward their organizations, as well. While about one in five respondents with

certifications feel they are paid well for their responsibilities, about 37

percent feel they are underpaid. Among those with professional certifications,

about 11 percent feel they are paid well and 43 percent think they don't get

paid enough for their responsibilities. Similarly, 31 percent of those without

certification see themselves as not well recognized within their organizations,

but only 23 percent of those with certifications feel the same. About the same

percentage of those with and without certification, about one in five, consider

themselves very well recognized.

Additional Findings

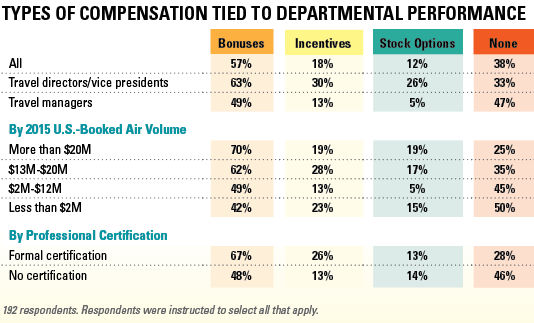

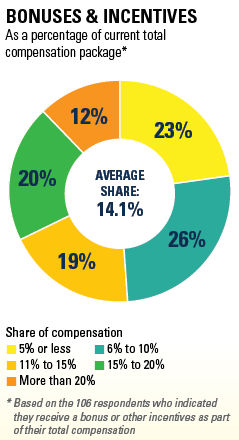

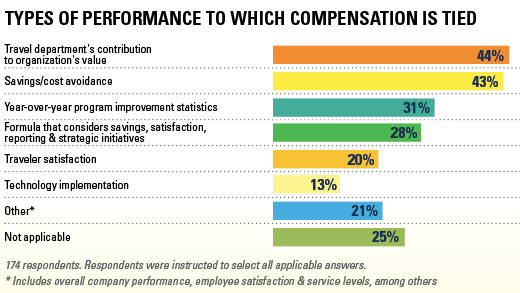

- About 62 percent of all respondents receive bonuses,

incentives and/or stock options that are tied to departmental performance. The

average value of those additional payments is a bit more than 14 percent of the

average total compensation package, though the responses were quite varied;

about 49 percent of respondents indicated that share of compensation was less

than 10 percent. That compensation was most typically tied to the respondents'

departmental contribution to organizational value as well as demonstrated cost

savings or avoidance, while others cited program improvement statistics, traveler

satisfaction and broader performance formulas as the basis for their bonuses.

- About 75 percent of those respondents from organizations

with 2015 United States-booked air volume of at least $20 million receive

additional performance-based compensation, but only 50 per-cent of those with

United States-booked air volume of less than $2 million do.

-

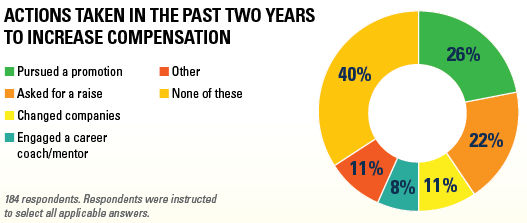

Arguably, the most direct way to receive a

raise is to ask for one, but that's a move that only 22 percent of respondents

have made in the past two years. About 60 percent had taken some direct action

in the past two years to boost their compensation; the pursuit of a promotion

was the most frequently cited method. Others have changed companies or engaged

a career coach or mentor in an effort to boost their titles and bank accounts.

Methodology

BTN’s 33rd annual Travel

Manager Salary Survey measures compensation and analyzes perceptions among corporate

travel professionals. It compares current salaries to the previous year,

determines how compensation is derived and shares job sentiments from those buying

and managing corporate travel. For the 2016 edition, invitation emails were

sent to Business Travel News and Travel Procurement subscribers,

as well as members of The BTN Group’s Research Council. Qualified respondents

indicated they are involved in travel and/or meetings management and/or

procurement. A total of 194 qualified respondents (72 percent female and 28

percent male) sufficiently completed an online survey questionnaire, though not

every respondent answered every question. Those who provided a job title

comprised 81 travel managers and supervisors; 19 purchasing, procurement and

sourcing executives; 14 travel specialists, advisors, coordinators, analysts

and buyers; 26 travel directors; 13 vice presidents; four owners, presidents,

CEOs, CFOs or COOs. Twenty-seven other respondents did not specify their

titles, or held titles that encompassed multiple disciplines. Polled travel

professionals represented a broad cross-section of industries. Among their

organizations, 13 percent had annual United States-booked air travel

expenditures of less than $2 million, 44 percent had such expenditures between

$2 million and $12 million, 15 percent had between $13 million and $20 million

and 28 percent had more than $20 million.