The number of trips booked by business travel agencies and

settled through ARC rose a modest 1.7 percent in 2015, a weak follow-up to 2014's

3.6 percent growth rate. The brakes on corporate travel were squeezed even

harder to open 2016, according to ARC business trip data and commentary from

airlines, travel management companies and global distribution system operators.

"The biggest issue in North America that's holding us back is the

slow-to-no growth in corporate travel," Sabre CEO Tom Klein told investors

in late April. For Sabre, leisure looked solid, but corporate travel was "muted,"

added CFO Rick Simonson. The numbers bear that out: Business trip growth rose

by less than 1 percent for the first three months of the year, according to

data based on ARC-designated agency code numbers.

It's too soon to tell, but the first quarter letup in

corporate air demand may be fleeting. A pickup would be welcome by TMCs, as

most are compensated for each transaction. That makes air bookings a key driver

of revenue. In May, Wolfe Research airline analyst Hunter Keay took the view

that "corporate travel demand is better than people realize," and he

expects improvements during the last six months of the year. Similarly, UBS

airline analysts viewed the downward revision in corporate budgets during the

first quarter as "a lagged reaction to the double-digit stock market

sell-off to start the year." There was more optimism for the second half

of 2016, UBS analysts wrote.

At the very least, the corporate air demand that drives TMC

revenue doesn't appear to be slowing further. Sabre Travel Network president

Sean Menke said in June that corporate demand has stabilized, "meaning it's

bottomed out." While Balboa Travel COO John Cruse also called out "a

little softening of demand in the first part of the year," he also noticed

a pickup in the second quarter. "It's not extreme, but it seems to be that

at the end of April and into May, things rebounded just a little bit."

Travelport CEO Gordon Wilson in early May said, "I'm not particularly

gloomy about corporate travel." The corporate slowdown was "a mixed

bag," depending on the industry sector, he said. Corporate travel for oil

and gas companies, which have been cutting costs since oil prices retreated

from their peak, was "clearly down." Yet, other sectors were doing "relatively

well." At the time, he noted that finance and banking was building up from

a lull.

What's a TMC to Do?

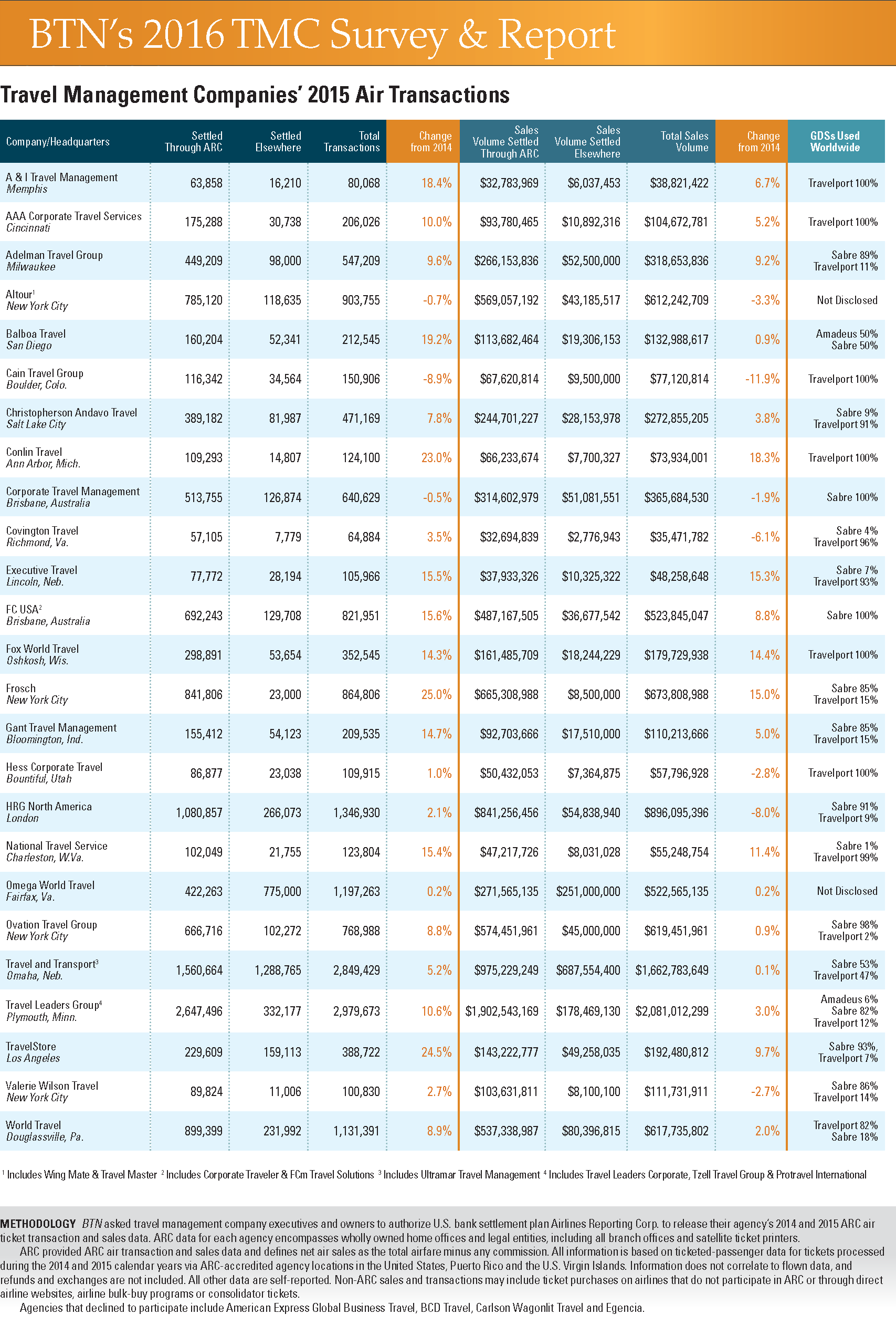

Among the more than two dozen corporate agencies that

authorized ARC to release their annual sales and transaction data for BTN's

2016 TMC report, the results also were mixed—but largely positive. Most

agencies registered transaction growth from 2014, some by double-digit

percentages. Just a few registered declines, and they were modest.

So, how's a TMC to accelerate business in a slow

environment? Winning new business and riding current client demand are option.

Fox World Travel posted 14 percent growth in both air transactions and sales

last year. "A lot of our existing customers are doing well, and their

travel is strong," said COO Lori Meress. "We're bringing on a lot of

new customers, as well. We haven't made any acquisitions for a number of years,

so this is organic."

While Fox benefited from some existing client growth, TMCs

exposed to corporate clients whose sectors are down, especially energy, have

been less fortunate. Carlson Wagonlit Travel, which did not participate in the BTN

survey, reported that its 2015 transactions declined 1 percent to 61.4 million.

"Excluding the impact of the energy portfolio, transactions increased by

1.3 percent," according to the mega travel agency.

American Express Global Business Travel chief global sales

officer Christine Ourmières-Widener sees the "three dimensions" of

organic growth at Amex GBT: organic client growth, expansions and new wins.

While not reflected in U.S. point-of-sale ARC data, global expansion is an area

of opportunity for larger multinational TMCs. "Organizations are

understanding the value of a global program, and duty of care is part of the

concern," said Ourmières-Widener. "Not only that, but it's about cost

savings, control and compliance."

In some cases, adding to a TMC's business travel portfolio

is as much about attracting smaller clients to the TMC sphere as it is about

taking away accounts from competitors, several small and midmarket agency

executives said.

Shopping Sprees

Yet another way for agencies to grow is through mergers and

acquisitions, a popular option for such travel agencies as Direct Travel,

Corporate Travel Management and Travel Leaders, each of which have made several

transactions in the past 18 months. Travel Leaders attributed about half of its

transaction growth last year in corporate travel to acquisitions.

Australia-based Corporate Travel Management continued to bulk up in the United

States. In April, it announced the acquisition of Travizon, its seventh in the

United States in the past four years. That followed December's deal to acquire

California's Montrose Travel.

Even mega BCD Travel got in on the act in May 2015 with the

purchase of Knoxville-based World Travel Service. Egencia, too, boosted its

size after bringing in Orbitz For Business, following parent company Expedia's

acquisition of Orbitz Worldwide. Egencia's first-quarter gross bookings rose 21

percent year over year due in large part to the inclusion of Orbitz for

Business results.

Innovative Travel Acquisitions president Bob Sweeney, who

has been brokering travel agency acquisitions since 1991, said the rate of

M&A in the TMC space has accelerated in recent years, driven in large part

by travel agency owners looking to retire.

Pressure on Client Pricing

Like many TMC executives before him, Travel Leaders Group

CEO Ninan Chacko bemoaned the commoditization of TMC services, as

procurement-minded companies have put pressure on the transaction fees paid by

clients. Cruse said Balboa's double-digit net air transaction growth last year

was "still very strong, but what happens over time is pressure on our

revenue streams: pressure on fees to come down, pressure on revenue streams

from airlines and hotels." Other TMCs shared similar observations. Hogg

Robinson Group chief executive David Radcliffe sees a rise in bidding activity

among clients. "There's a lot of activity out there at the moment,"

he said in May. "When times get tough or uncertain around the globe, you're

bound to get everyone saying, 'Are we getting the best deal? Is there something

better that we can get?'"

To counter the pricing pressure from corporate clients, some

TMCs are diversifying to lessen their reliance on booking fees. Travel Leaders,

Travel and Transport and others have grown their portfolio of offerings via new

data consolidation and analytics services. Plenty of agencies are talking more

about meetings and events and consulting, as well. "Obviously, the number

of trips customers take is a function of their business needs, but we want to be

able to also do more within each of those companies," Chacko said. "Clearly,

our core offering is travel fulfillment. We've made pretty good strides in

terms of consulting—so broadly speaking: data intelligence, consulting and

analytics—and then, to some degree, also meetings and meetings management. We've

been able to not just maintain but also grow our footprint across existing

clients and attract new clients, both through organic and inorganic means."

GDS Incentives Are a Bright Spot

In addition to the revenue TMCs get directly from clients,

agencies earn overrides from airlines, commissions from hotels and incentives

from GDS operators. Several TMCs, including BCD Travel, have put more focus on

selling hotels, a nice revenue opportunity. BCD CEO John Snyder noted in

December that "hotel booking is a very key initiative for us." He

cited the industry benchmark 50 percent hotel attachment rate, "very low"

in his words. "Literally, just moving the gauge 2 or 3 percentage points

drops millions of dollars to the bottom line for us," he said.

Per-transaction GDS incentives, meanwhile, rose steadily last year and continue

to move upward. Travelport forecast a "low- to mid-single-digit escalation

in incentives" in 2016, much the same rate of growth as in 2015. Sabre's

annual report noted incentives have been "increasing in real terms,

growing in the low-single digits on a per-booking basis in recent years."

As the three major competing GDSs duke it out

for market share, they have sweetened the pot for agencies. "The deals are

getting better than ever and the downside penalties for not making enough

bookings seem to be getting more lenient than ever," said industry lawyer

Mark Pestronk, who assists agencies with GDS contracts. "The balance of

power has shifted somewhat toward agencies and away from the GDS vendors in

these negotiations throughout the years."

The results of BTN's 2016 TMC Report appear below. For a high-resolution look, click here.