The future of airline booking demand doesn’t look as bleak as some might think, according to PROS chief AI officer Michael Wu.

As we close out the year with another surge in Covid-19 cases, it’s clear there are many questions left around what a short-term and long-term airline recovery will look like. While the holiday season is off to a rough start, with the U.S. Centers for Disease Control and Prevention urging Americans not to travel for Thanksgiving, not all hope is lost. In fact, one predictive model shows that we could see a significant recovery for airline bookings as soon as in the next three to six months.

About eight months ago, AI-based data intelligence firm PROS assembled a Covid Taskforce to help airline customers cope with the pandemic. By combining opt-in demand data from about 20 global airline participants, we’ve created a global predictive model that will more accurately forecast when and how bookings will return. This model is truly unprecedented—airlines are hypercompetitive, and because their margins are so thin, many have been unwilling to share data in the past.

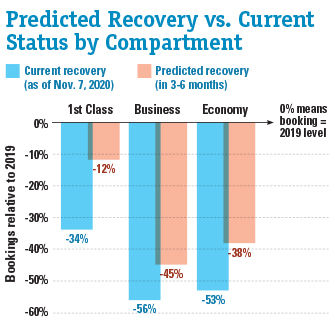

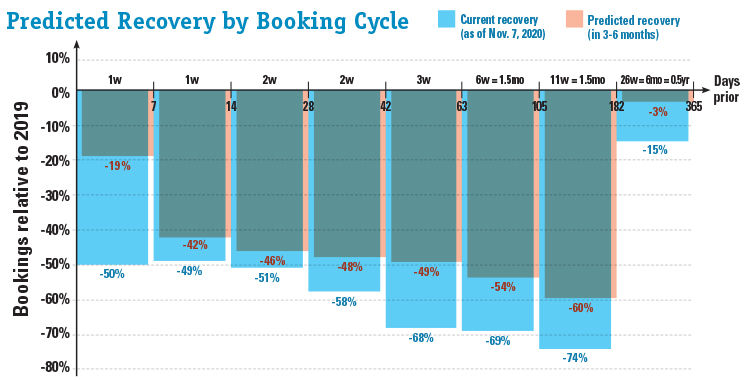

In the following predictions, all data are normalized to 2019 levels to obfuscate the market shares of airline participants. Each of these predictions for recovery three to six months out is compared to the current recovery status as of Nov. 7, 2020.

How Will Passenger Mix Fare?

It’s to no one’s surprise that amid lockdowns and the emergence of remote work, business travel has fallen dramatically. In three to six months, we predict a significant recovery (around 22 percent) of first-class passengers. However, business- and economy-class passengers will only recover about half of this amount (relative to 2019). Perhaps flying is now reserved for those who have the means to do so as in the early days of our aviation history.

Which Regions Have the Strongest Flight Recovery?

We also took a look at how flight recovery will fare across five regions: North America, South America, Europe, Middle East, and Southeast Asia, and analyzed three types of flights: domestic, international within a region (intraregional) and international between regions (interregional).

Domestic flights are currently seeing the most recovery, followed by interregional, and then intraregional flights. This pattern is persistent in our predicted recovery three to six months out.

In the next few months, we can expect to see a fairly consistent (~10 percent) recovery for interregional flights across all regions. Intraregional flights, on the other hand, will be more variable, ranging from ~5 percent in the Middle East to ~25 percent in North America. This variability is even more pronounced for domestic flights, ranging from ~5 percent for Europe to ~35 percent in Southeast Asia.

Based on our model, we expect to see a near full recovery for Southeast Asia domestic flights to a level that is only 5 percent below the 2019 level. One major factor at play is the cultural advantage in Southeast Asian countries (e.g. mask wearing) that allows them to more effectively curb the spread of Covid-19.

Bookings More than Six Months Out Will Fully Recover

What will airline booking and desire for travel look like in the future? Since people can book flights up to one year before their departure date, and there tend to be much fewer bookings for a further-out travel date, it’s a common practice to bucket the number of booking in days-prior to the travel date into timeframes of different length.

We are currently seeing a roughly 50 percent to 75 percent drop in booking relative to 2019 in all bookings up to 6-months before the travel date. But we are only seeing a modest drop of 15 percent for travels that are more than six months out.

In three to six months, however, we can expect to see a significant bookings recovery (around 30 percent) for travels within one week. In uncertain times, people tend to book much closer to the travel date. For travels more than one week out (up to six months), we will see a 5 percent to 20 percent recovery from the current status. And, for bookings for travel more than six months out, we are predicting only 3 percent below 2019 levels—meaning a nearly complete recovery.

[Op-ed continues below chart.]

This is good news for the travel industry, because it shows that there is still a strong appetite for travel. However, the fact that these bookings are for travel far in the future means consumers also have a lot of time to change or even cancel these bookings. So if airlines are offering no penalty for cancellation, this predicted full recovery in bookings (as real and accurate as it may be), could merely be a reflection of consumers taking advantage of these flexible cancellation policies.

A Unique and Unprecedented Approach

How do we know these predictions are accurate? We’ve built a booking-prediction model using a highly flexible machine learning model (i.e. random forest) that, in theory, can model any data. This model has been trained and tested with three major data sources: aggregating booking data (approximately 625 million bookings globally, and growing at approximately 13.9 million bookings every week) from airlines, epidemic data from Johns Hopkins University and government response data from Oxford University.

To make predictions about future bookings, we also leveraged data from the Institute for Health Metrics and Evaluation of the University of Washington’s medical school to help forecast the coronavirus epidemic and estimate governments’ response with cell phone mobility data. By combining all of these data sources, our model is able more accurately reflect reality.

Only time will tell if our predictions will become a reality, but based on our findings rooted in data science, the future of airline bookings doesn’t look as bleak as others may have suspected.